APPROACHING FINANCIAL SERVICES INDUSTRY CHALLENGES IN 2022

APPROACHING FINANCIAL SERVICES INDUSTRY CHALLENGES IN 2022

The ongoing digital transformation process financial services institutions have to embrace today is in equal parts promising and challenging. The latest technologies create numerous pitfalls for conventional financial companies that try to take steps toward satisfying the new digital needs of their customers. However, fintech is not the cause of the problems but rather a straight path to their solution. Here’s how leveraging financial technologies can solve all the topical banking industry challenges.

Challenge #1: Keeping up with ever-growing customer expectations

Unmatched customer experience is what every financial services company dreams to provide to eliminate client churn and ensure leading positions in the industry. To meet the goal, financial institutions have to offer an all-in-one banking solution that will allow people to carry out all the necessary monetary operations quickly and conveniently since conventional “in-person” banking services strategy can’t fulfill everyday customer needs anymore.

Solution: Mobile banking technology & Microservice architecture

Developing a solid and intuitive fintech mobile banking application is an undeniable trend in the industry. The number of people using online banking will reach 3.6 billion in 2024, proving that a financial services company aimed at continuous growth and improvement can’t avoid leveraging mobile banking technology. The popular request for a comprehensive app that enables customers to perform financial transactions, make investments, pay bills, sign papers, and complete other fiscal actions can be backed by incorporating microservice architecture. The app development style allows companies to build an agile multifunctional financial product that supports a variety of in-app services.

Challenge #2: Maintaining competitive positions

Being competitive in fintech means understanding consumer needs and providing relevant solutions before your industry rivals. The financial services industry is one of the highly rivalrous and quickly developing domains where being open to changes and innovations is the key to staying afloat. Digging for emerging fintech trends and incorporating them smartly is what your business needs.

Solution: Autonomous finance technology & in-app cryptocurrency exchange

Data science in conjunction with AI and ML has brought to life a technology that turns banking apps into virtual assistants that help customers make informed financial decisions and manage their budgets more efficiently. Autonomous finance technology provides artificial intelligence-backed advanced analytics and can perform money operations automatically based on personal user requirements. Another forward-looking step would be to incorporate the cryptocurrency exchange feature into your mobile app. Digital currency is sure to acquire a solid place in our everyday life so if you want to be among the pioneers who support cryptocurrency exchanges - now it’s time to get started.

Challenge #3: Protecting customer financial data at all costs

Cybersecurity has always been a painful and longstanding issue for the industry. Digitization hasn’t made the financial environment safer but created a new susceptible environment that each year loses around $27 billion due to data breaches. Customer trust as the most fragile and valuable asset financial service companies work for, has become even more endangered together with businesses’ reputations.

Solution: Open Banking and Blockchain Technology

Solid data protection has taken center stage in fintech. Currently, there are two most trendy concepts targeted at data breach elimination in the financial industry. Open banking is a way of protecting sensitive customer information by bridging the gaps between various financial institutions a person turns to and creating a safe environment for sharing customer data among them. Blockchain solution has already proven itself to be an exceptionally effective and highly resultative means of mitigating money-losing risks and is predicted to change the way the financial industry functions for good.

Challenge #4: Managing Regulatory Requirements

The payback for the benefits of leveraging the latest fintech technologies is compliance with an increasing number of regulations. Meeting the requirements at all levels is a major issue for fintech companies of all sizes. Apart from regulatory complexity, non-compliance fines present a significant problem depriving businesses of massive parts of their revenues. Automated technologies that have caused the issue have to become its solution.

Solution: RegTech

In attempts to create the technology that would unburden fintech companies from manual monitoring of the compliance with the existing and emerging regulations, AI and ML scientists have introduced RegTech. The tool addresses the issue by acting as a regulations enforcement supervisor and helps businesses avert penalties.

Challenge #5: Big Data

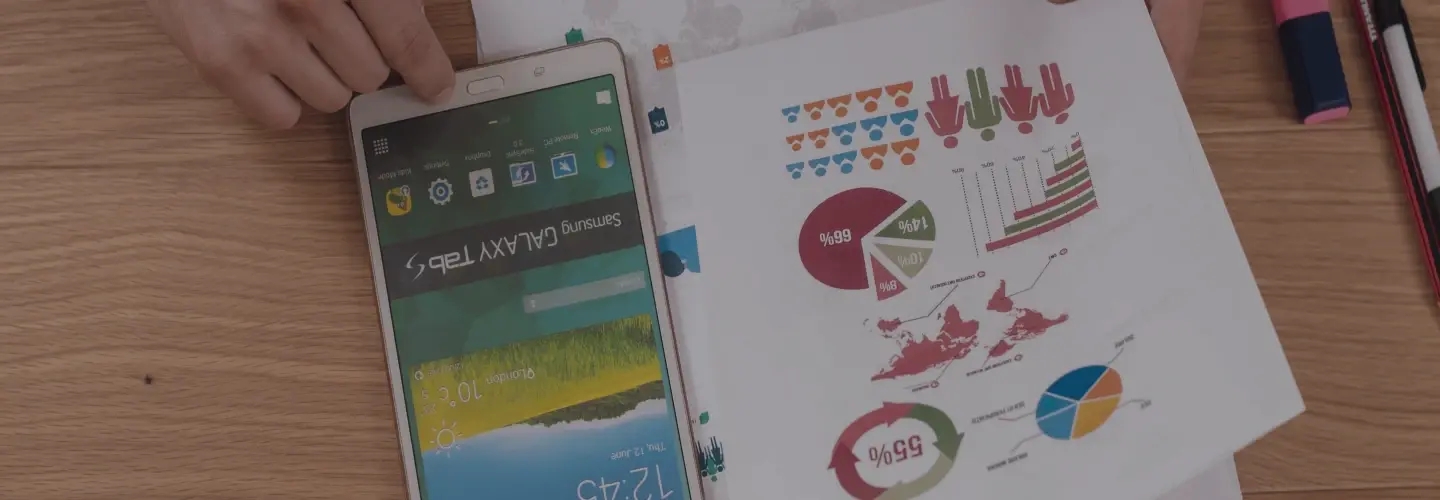

Fintech is one of the most data-intensive industries that obtains zettabytes of data through a variety of sources. The amount of information and the diversity of formats it comes in makes it extremely complicated to analyze and get valuable insights. Big data, if managed poorly, creates clutter and prevents financial institutions from achieving their business goals.

Solution: Data Science Incorporation

Big data leverage is an undeniable must for financial business players since the industry is becoming extremely reliant on advanced data analysis and ML-powered predictive analytics for successful strategy building, effective marketing, investment, and automation of routine processes. Data science is an essential fintech tool that brings structure and clarity to company’s everyday running and uncovers the potential of chaotic information input.

Choosing a Reliable Fintech Solutions Vendor

Immersing into fintech is always safer with an expertised guide beside you. Here’s a tip on how to spot one.

Financial Industry Expertise

The number of successfully launched projects and implemented fintech industry solutions is not just a figure but a quality guarantee. Helping our partners to address the challenges they encounter along the way, Modsen has developed strong expertise and expanded its experience to be able to provide top-notch fintech services.

Individual Approach

Although the fintech businesses share the same industry background, treating them on the basis of a one-fits-all approach would be a mistake. Our team has generated dozens of unique ideas and solutions for our fintech partners taking into account their needs and aspirations to bring maximum value to their businesses.

The Bottom Line

New technologies create new challenges for financial institutions trying to stay relevant among the emerging fintech companies. The innovations induce the industry to change drastically in favor of customer experience and there’s no turning back. The only way to deal with modern financial services problems is to embrace the new technologies and focus on the immense opportunities they bring for your business.